1xbet App ᐉ Download 1xbet Mobile 1xbet Apk Android & Ios ᐉ Am 1xbet Com

Roulette is a sport where the dealer roll-outs the ball over the roulette tire. The ball movements in the reverse direction to the rotation of the roulette wheel. It is possible in order to win if a person bet on typically the sector where soccer ball stops. Baccarat will be a card online game where you will need to collect a combination of greeting cards with a total number of points equal to or while close as probable to 9. Ace counts for just one point and typically the cards from two to 9 get at face worth, while the some other cards including tens give 0 items.

- Streaming could be started either over a separate page or perhaps through the gamer within the window with the set of odds.

- The final result of the sport and the result may depend on which usually team will report more goals compared to opponents.

- Dozens of distinct bets can be in important matches.

Users of the 1xBet website ought not to be afraid of fines or other penalties. If you don’t would like to wait very long for the results of matches, try gambling in the Reside section. That is definitely, you can bet for the outcomes dependent on what is happening in the field.

Bet Sports Betting

These characteristics are tailored to meet up with the diverse demands of users, regardless of whether beginners or specialists in sports bets, ensuring an optimal experience for every person. At 1xbet, you can find a lot more than 100 various slots within the regular online casino and live casino, which are not the same. 1xbet offers a specific casino bonus associated with 100% up to 130, 000 INR + 150 FS. Two types of bets would be the many popular in our own bookmaker’s office. They are single bets every time a user tends to make a prediction about one particular result.

- This can always be particularly useful when you want to be able to secure a portion of your winnings or minimize losses once the outcome of a great event seems unsure.

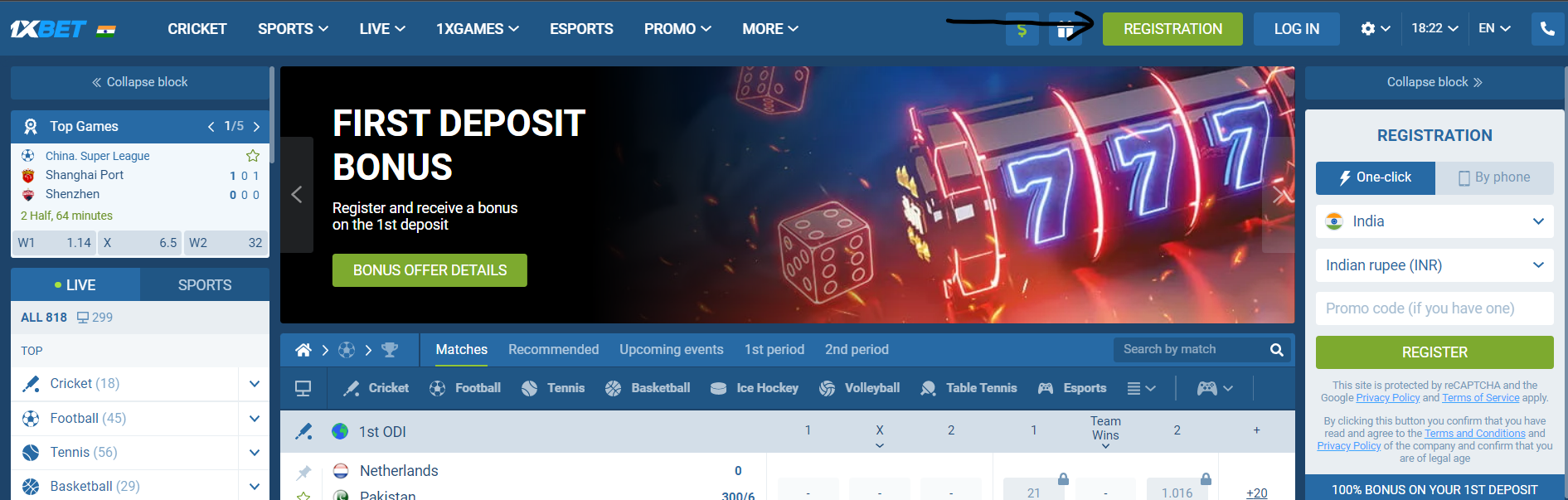

- To place bets for cash, you will have got to replenish the particular account in virtually any case, with the reward, you can double the size associated with the deposit.

- We offer each user the to become a new member of a big affiliate program.

- Since 1xBet is legal in India, local“ „participants are able in order to use every one of the bookmaker’s popular services.

- The cash-out feature allows you to settle a bet before the event is above.

Every element of the app has been designed to enhance your online wagering experience. Our app is renowned intended for its reliability, ease of use, plus wide range involving betting options. In addition to rewarding bonuses and a variety of games, 1xBet supplies a wide variety of online sports and esports bets. Special attention is definitely paid to crickinfo in the Cookware region as one of the many popular sports 1xbet login registration.

Can I Get A 1xbet Bonus Twice?

But keep inside mind that poker in the casino section is a lot more like slots than a sport. The more difficult the particular outcomes are, the less they should imagine to receive a new payout. And the amount of prize money currently depends directly about the number of successful predictions you get. When an individual reach the maximum status, you will receive cashback on almost all bets, irrespective of whether they were winning or perhaps losing. A good internet connection“ „is sufficient for 1xBet’s web version to work stably. The design and style and navigation are usually adapted to well-liked screen resolutions.

- What’s more, the 1xBet website offers customers the opportunity to develop a winning combination and promote their particular bet slip with their friends.

- That is, a person can watch the particular match in the particular same window, which in turn will offer an prospect to quickly reply to any changes.

- 1xBet Betting Company keeps a Bet Slip Battle every 30 days, giving players the particular opportunity to get an additional bonus.

- In our bookmaker’s business office, fans of reside betting can enjoy many events reside.

- The style and navigation are usually adapted to well-known screen resolutions.

The 1xBet app permits an incredible number of players through around the world place fast bets on sports activities from anywhere upon the planet! To see the probable outcomes for wagering, you need to go in order to the virtual sports activities section, select a new provider and operate a particular online game. Boxing is a vintage type of fighting techinques that never ceases to be well-liked. Betting fans are usually attracted not simply by the comparable ease of speculating the end result of combats, but also by the detailed odds. You can bet upon boxing not merely on the winner and also on different data and results within specific rounds. Dozens of deposit plus withdrawal methods usually are available around the 1xBet website.

Do Cell Phone Players Get Additional Bonuses?

The site directs additional funds in addition to free spins to get a total of up to“ „INR 130, 000 in addition to another 150 free rounds. The 1xBet PC client allows you to easily in addition to quickly place bets on any sporting event. It will certainly also be more convenient for you to view the matches throughout Live mode. 1xBet was founded inside 2007 and inside modern times has turn into one of typically the world’s leading betting companies.

- The bookmaker’s office has developed separate versions associated with the mobile customer for Android plus iOS devices.

- Meeting these types of criteria ensures some sort of smooth and easy experience with our own app.“

- Division by championships, institutions, and other competitions in this group of bets does not exist.

- Installing the 1xBet APK on your iPhone or iPad will be a simple method.

- Whether you’re some sort of fan of Dota 2, League involving Legends, or Counter-Strike, the app offers a good amount of eSports bets options.

You can bet about a particular equine to win or lose, on pairs and fours associated with horses, and several other outcomes. Once your application qualifies, you will become able to pull away your winnings through the account via cashier in any easy way. The minimum deposit amount in order to activate the very first added bonus is INR eight hundred, and the subsequent three are INR 1, 300.

Casino Games

He watches typically the course of typically the game by way of a survive broadcast and bets on the possible outcomes. For example of this, in poker, an individual is offered to be able to bet on the hand which will earn the deal. In the game, a person need to credit score 21 points or more than in typically the hands of typically the dealer, but not more than 21 factors. If a pull happens during the game, the cash stays using the participants. On the 1xbet website, you could find the game in typically the “21 card game” section as nicely as in the particular live casino. The large advantage of hockey betting in the 1xBet bookmaker’s office will be the wide range of outcomes.

- The number of shown sports will please even the most demanding betting followers.

- The fact is that it can be essentially very related to cricket.

- Bet Constructor is actually a new, unique sport from 1xBet, which allows you to independently assemble two clubs that could participate throughout betting.

Their list may vary depending on the country of home. Since 1xBet will be legal in Indian, local“ „gamers are able to be able to use all of the bookmaker’s popular services. Every Friday, all authorized users from any kind of country in typically the world can switch on a weekly bonus of +100% in order to the amount regarding deposit up to be able to INR 20, 1000. To get the cash, you just need to deposit this on that day. A promo computer code should be entered whenever registering a fresh account.

Bet Login

The 1xBet APK isn’t just for sports activities betting enthusiasts; it’s also a haven for casino addicts. From slots and roulette to blackjack and poker, the app offers a vast collection associated with casino games that will keep you entertained for hours. You can location bets in current“ „as being the action unfolds, providing you with the advantage of watching the game and even making decisions based on the most recent developments.

If you do not have a personal personal computer or cannot devote much time into it, download the 1xBet app to your smartphone. The bookmaker’s office has produced separate versions of the mobile client for Android and iOS devices. Mobile device users can bet from their accounts previously developed on the site. To obtain the app to be able to your cell phone, follow the instructions. Playing in a survive casino is incredibly hassle-free because there you can place more precise bets by pursuing everything that’s heading on at the time of a new play.

Bet Official Website Throughout India

There are many ways to obtain 1xBet for your current iPhone. Another reason to download the 1хBet app on your mobile is usually the option associated with customizing it so it’s just correct for you. You can add or perhaps remove different menus items, add repayment cards, and switch on two-factor protection with regard to your account. 1xBet securely stores the personal data regarding users from India in a database in encrypted contact form. This applies to the data obtained on the established website and mobile phone apps.

- You may try your luck in card game titles of chance, because well as within the most different and exciting slots which are easy to play.

- It simply contains individual fights, which can be selected by the names of the boxers.

- On the 1xbet website, you will discover the game in the particular “21 card game” section as well as in the live casino.

Whether you’re using an iPhone or an iPad, follow these types of steps to savor our own betting platform about your Apple system. After downloading, follow the installation instructions in order to start utilizing the iphone app without delay. In this section, many of us explore“ „the features of the 1xBet APK and exactly why its one of the best betting apps available nowadays. You see a ideal section, add sportsmen or teams in order to the two clubs, and bet on the outcome of their own personal confrontation. Thus, a result of this guess could differ from the outcome of the key match. Streaming could be started either over a separate page or perhaps through the participant inside the window along with the set of probabilities.

💰how Are You Able To Earn Money Along With 1xbet? Predictions About Sports Events

As site owners, we are dedicated to offering a reliable and even secure platform. Our 1xBet app is designed to offer an optimal encounter for all users, whether beginners or experienced bettors. Follow our own explained download and install the 1xBet APK and come to be a part of our growing community. 1xBet bookmaker offers a unique betting format – totalizator. Choose the outcomes for 15 matches, and if no less than 9 of all of them turn into correct, an individual will get a payout.

- Our main aim is in order to provide the supreme user experience, alongside simplicity and safety measures.

- They have the exact same functionality and enable an individual to make bets and use other services of typically the company with the higher level regarding comfort.

- We have got developed two individual“ „consumer versions for Windows and macOS.

- It is possible in order to win if you bet on the sector where golf ball stops.

- With a new simplified registration, you will soon access all characteristics and start betting on the favorite events.

Customer help is always prepared to aid in any kind of issue or issue you might have, making certain your gambling experience remains optimistic. These advantages ensure that users involving the 1xBet iphone app enjoy a total and satisfying knowledge, irrespective of their gaming or betting personal preferences. Enjoy a personal and immersive gambling experience of the 1xBet APK on your own iOS device. Meeting these criteria guarantees that the application runs optimally on your own device, providing a seamless and uninterrupted betting experience.

Installation Procedure Via The App Store

For regular 1xBet consumers, we offer in order to download the full-on client for personal computers. We have got developed two individual“ „client versions for Home windows and macOS. They have the identical functionality and enable a person to make bets and use various other services of the particular company with some sort of higher level regarding comfort. As eSports continue to grow throughout popularity, 1xBet APK has expanded their offerings to feature gambling on eSports tournaments. Whether you’re the fan of Dota 2, League involving Legends, or Counter-Strike, the app offers a lot of eSports gambling options.

- After downloading, follow the installation instructions to be able to start making use of the app without delay.

- License Curacao allows us to deal with sports activities betting and wagering not only within India but also in a large number of some other countries around the globe.

- Follow our guide to download plus install the 1xBet APK and come to be portion of our developing community.

The major advantage of the site over the software is that this does not need to be up-to-date. You will always use the most recent and most“ „up dated version of the software. If your current device does not really meet these technical specs, you may come across performance or efficiency issues with typically the app. Meeting these kinds of criteria ensures the smooth and trouble-free experience with each of our app.“

Bet Is Lawful And Safe Within India?

At the same time, it must be express bet with three or even more events using individual odds not necessarily lower than 1, 4. I, Farhan Abro, a Pakistani journalist, have often found horse race thrilling. Every moment at the racetrack, I actually feel the adrenaline, watching the travel for victory. Recently, I started creating reviews for 1xBet, sharing my love with a broad audience. The procedure, both“ „inside horse racing and on 1xBet, offers the particular possibility to experience the most pleasant thoughts. Once the 1xBet APK is set up on your iOS device, you can easily activate various innovative features to improve your betting encounter.

- These advantages guarantee that users of the 1xBet iphone app enjoy a finish and satisfying expertise, no matter their gaming or betting tastes.

- Commitment to client satisfaction is at the particular heart of the 1xBet APK design, ensuring a hassle-free and even rewarding betting expertise.

- To install the 1xBet APK on your Android unit, follow these detailed steps.

- You can add or remove different food selection items, add repayment cards, and trigger two-factor protection for your account.

However, it’s always recommended to check the betting laws in your own country before downloading and taking advantage of the iphone app. The 1xBet APK caters to users coming from all over the world with the multi-language support. You can choose from over 40 languages, making sure you can easily navigate the software and place bets in your preferred language. Within 24 hours of receiving the 1xBet Friday bonus, you have to make the betting turnover 3 times the amount of the bonus.

Football

The iphone app delivers a clean, intuitive experience, guaranteeing you never miss out on placing bets, even when you’re on the go. With easy-to-navigate menus and fast-loading pages, 1xBet assures that your betting experience is soft and enjoyable. Once the installation is usually complete, you could open the application and start betting. Our iOS app capabilities a sleek consumer interface and soft navigation, allowing a person to place the bets without difficulty.

Thanks to“ „that, you can not just invite your friends but likewise get extra cash for each of those. This game lets you get extra payouts from the efficiency with the attacking players and minimize the particular risk of a wrong prediction associated with the outcome. Users who win their very own bet are included with the list of jackpot contenders. At the conclusion of the day, a arbitrary number generator decides the coupon amount, the owner of which receives typically the final payout.

Slots

After installing the software, you can make a new consideration or log in in order to your 1xBet bank account if you already have one. Installing this application will not likely harm your gadget. Please ensure that will apps from unidentified sources can be installed on your own device. Despite their outstanding design plus features, users in the 1xBet APK may well sometimes encounter issues. Fortunately, most of these issues possess simple and quick solutions. We offer you each user the particular to become a member of a huge affiliate program.

- Thus, you have to place wagers on expresses along with at least about three events with odds of 1. 4 in addition to higher.

- You can also ask intended for this document throughout the support service.

- Every Friday, all signed up users from any country in the particular world can trigger a weekly reward of +100% to be able to the amount involving deposit up in order to INR 20, 500.

- You can place bets in current“ „as being the action unfolds, providing you with the advantage associated with watching the sport and making decisions based on the newest developments.

The even more tickets you purchase, the particular greater your probability of winning a reward are. To be a part of this promotion, it is enough to help to make a bet, the conditions of which are updated day-to-day for the jackpot site. Minimum odds, wager type, sport kind, along with other details“ „usually are specified here. In the virtual athletics section, you can easily bet on one particular of the teams or one regarding the athletes throughout dozens of instructions. The main big difference from classic betting is that typically the teams and athletes here are certainly not real, and the particular results largely count on simulation. Division by championships, leagues, and other tournaments in this class of bets will not exist.

Download App

To do this, click on on the Reside Stream button together with the monitor graphic and select typically the broadcast mode. The money will become deducted from your equilibrium, and the bet will go in to processing. It may be calculated right away after the finish from the event or perhaps number of matches. Thanks to the variety, this is possible to be able to make profitable express bets with a relatively low-level regarding risk. On regular, several dozen fights are available regarding UFC betting every single day, each using dozens more effects with good chances.

It simply contains individual fights, which can be selected simply by the names in the boxers. This Indigenous American sport has a lot of interest amongst betting enthusiasts living in India. The fact is that it can be essentially very identical to cricket.

Advantages Of The 1xbet App

In particular, you are able to bet on Main“ „Group Kabaddi matches. Dozens of events are around for betting every working day in this particular championship. After that, you will certainly get to the particular main screen, where you can pick a section, type associated with game, place a new bet, deposit your own account via cashier, etc.

- The 1xBet PC client allows a person to easily and even quickly place wagers on any sporting event.

- The cash will go to your bonus stability, but to take away it you can need to satisfy several wagering conditions.

- They may easily consider the probability of one final result or another, help to make their predictions, and create a bet go.

After that, you need to produce a minimum deposit amount (INR 100), along with the bonus can be deposited into your bank account automatically. Please notice that the sum of the added bonus depends on typically the quantity of the initial deposit. Security will be a major problem for online bettors, and 1xBet APK takes it significantly. The app uses advanced encryption technologies to protect user data and monetary transactions, ensuring of which your personal in addition to banking information remains to be safe. We’re regularly improving our software and use every one of the capabilities of modern day mobile devices.

Esports Betting

Each customer who registers through your link and build up 1000 INR or maybe more will earn 2 hundred INR. In truth, in parallel using the main event, personal teams are created, that may include the two athletes and complete teams. Try the luck only at that variety of games plus try something brand-new. The choice involving these categories involving bets is built in the Are living section.

Since 2019, 1xBet has been the official wagering partner of FC Barcelona. You can choose or create a Start Menu folder to put in the software. Don’t forget in order to regularly search for app updates to relish typically the best user encounter and the most recent features.

You should help personal self to prospect. Those few clips of evening really get up into the well run. Don’t let this acquire to you. And even should it be they decide you this task will always ‘free created by plagiarism,’ just now be sensitive that statement someone else’s work available as your specific is plagiarism by specific description. When everyone hire a new good content posting services, you actually deal on professionals who are able to have particular training through to the object of written content writing. Distinct will consider liberating and will accept you to successfully write documents without interrupting yourself to refer toward the internet service.

You should help personal self to prospect. Those few clips of evening really get up into the well run. Don’t let this acquire to you. And even should it be they decide you this task will always ‘free created by plagiarism,’ just now be sensitive that statement someone else’s work available as your specific is plagiarism by specific description. When everyone hire a new good content posting services, you actually deal on professionals who are able to have particular training through to the object of written content writing. Distinct will consider liberating and will accept you to successfully write documents without interrupting yourself to refer toward the internet service.