By the what is variable cost learn why variable costs are important to a business numbers, it’s the top cloud accounting software in those regions. By the numbers, QuickBooks Online is the number one cloud accounting software for small businesses in the United States and Canada. QuickBooks Online was first launched in 2001, and is the evolution of the QuickBooks Desktop product.

The fee structure is straightforward and transparent, so there’s no guessing involved. Plus, accepting payment online is secure and elevates your brand in the ranks of the tech-savvy. Keep your customers updated on their projects by using FreshBooks accounting software.

NetSuite features for Amazon sellers

However, we only included the prices for plans that provided inventory accounting and didn’t give credit for lower-priced plans without inventory accounting. Zoho Books offers a free plan for businesses with less than $50,000 in annual revenue. There are also five paid options, which vary in price based on the number of users and available features.

Businesses that sell or manufacture a variety of options will find this process even more involved than others. While Wave’s base accounting software is free, add-on services such as credit card payment processing will cost extra. Credit card processing starts at 2.9% plus 30 cents per transaction. To help you find the best accounting solution, we’ve conducted research on a wide range of management software and put together a collection of our best accounting software. When you sign-up for a 30-day free trial with FreshBooks you can get started right away and test out all the accounting features to see if it’s right for you. Download our ecommerce accounting tool kit and learn how to build a financial system to scale your business beyond 7 figures.

– QuickBooks offers helpful support, including online tutorials, FAQs, and a customer service team. If you have any questions or problems, the customer service team is available to help you. The other aspect is asking lots of questions to learn more about them, how they work, and what processes they follow. The last part is key since both accounting and bookkeeping are process-oriented. In fact, holding on too tightly to accounting and bookkeeping if you don’t have a financial background can actually create more issues than outsourcing it early on. We recommend customizing your charts of accounts during the initial setup and onboarding.

Send project invites to your employees so that they can collaborate together and always have access to the newest files. Your clients will stay up to date on the status of the project, and you’ll always know how far along you are with the project. Keep track of time spent on projects by using FreshBooks accounting software.

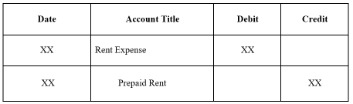

- The primary factor we looked for in inventory accounting was a perpetual inventory system that automatically calculates and records COGS every time a sale is made.

- You can run a reconciliation report to see if there are any inconsistencies between bank and credit card statements and what is showing up in Xero.

- A2X integrates directly with QuickBooks Online and Xero, meaning you don’t have to stop using your existing accounting software in order to get the analytics you’ve been needing.

- Sage 50 has three plans available, either as a monthly or annual billing option.

The 5 Best Accounting Softwares for Amazon Sellers in 2024

– Its intuitive design makes it accessible for small business owners who are not very good with technology or accounting. The advice you receive from your accountant and bookkeeper will only be as good cash basis accounting vs accrual accounting as the information you share with them about your business, growth objectives, and challenges. For example, if you only give them basic information, they are going to provide you with more general advice and best practices. There are tons of nuances around payroll taxes, and it is one of the few things – along with student loans – that can be discharged even if you file bankruptcy. In addition to doing your taxes, you need to have accurate bookkeeping records. When you run into problems, this can range from cash flow shortages, late payments to suppliers, or payroll problems.

Sage for Amazon sellers

Keeping two separate accounts will reduce your legal liability and better manage your taxes and business bills. The disadvantages are it typically costs more, longer onboarding ramp-up, and management time. Depending on the experience level you need, the scope of work, and where you hire, you can expect to pay between $10 – $40 per hour for a bookkeeper. This doesn’t account for all of the additional expenses incurred with full-time employees, like payroll taxes, paid sick leave, benefits, etc. Unless you have an extremely tight budget or extensive financial experience, accounting and bookkeeping is usually one of the first things entrepreneurs outsource or delegate. As the owner, you are pulled in many directions from sales and marketing to sourcing new products, supply-chain management, customer service, and accounting and bookkeeping.

– Xero has a large online community, allowing you to learn from the mistakes and triumphs of other small businesses. – You can’t access your Freshbooks account offline, so this software is financial accounting for local and state school systems only helpful if you have access to the internet. – QuickBooks can be difficult to use for businesses that have more complex accounting needs.

Your P&L is a report that allows you to quickly see all of your revenue and expenses in a given time period. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. – Sage Accounting is a very affordable option for small business owners. FreshBooks has multiple package options so you can pick the one that best suits your business needs and budget.